Introduction to Savastan0

Building strong business credit is crucial for any entrepreneur looking to grow their venture. But the path to establishing that credit can often feel complicated and overwhelming. Enter Savastan0, a game-changer in the world of business finance.

This innovative solution is designed specifically to simplify the process of building business credit quickly and effectively. Whether you’re a startup or an established company, having solid business credit can open doors to better financing options, supplier relationships, and even lower insurance premiums.

With Savastan0 at your side, you’ll discover how easy it can be to enhance your financial reputation and secure the growth you’ve always envisioned for your business.

Let’s explore what makes Svasatan0.cc so essential for entrepreneurs eager to build strong business credit fast.

How Savastan0 Helps in Building Business Credit

Savastan0 streamlines the process of establishing solid business credit. It provides businesses with tailored strategies to improve their creditworthiness.

With its user-friendly platform, Savastan0 helps entrepreneurs understand what lenders look for. This insight is crucial in positioning a business favorably in the eyes of creditors.

Additionally, Savastan0 offers tools that track financial metrics. Users can monitor their progress and make informed decisions based on real-time data.

Another advantage is access to resources such as educational content and expert advice. These resources empower business owners to navigate the complexities of credit building effectively.

By leveraging networking opportunities within the Savastan0 community, businesses can also connect with potential partners and mentors who share valuable experiences related to credit growth.

Savastan0 Importance of Building Business Credit

Building business credit is crucial for any entrepreneur. It opens doors to better financing options, allowing businesses to access loans and credit lines more easily.

Strong business credit signals reliability to lenders and suppliers. This trust can lead to favorable terms and lower interest rates, directly impacting a company’s bottom line.

Moreover, good credit enhances a company’s reputation in the market. It helps build relationships with vendors who may offer discounts or extended payment terms based on your credible financial standing.

In today’s competitive landscape, having solid business credit is not just an asset; it’s a necessity. Companies without it risk losing opportunities that could drive growth and innovation.

Success Stories of Businesses Using Savastan0

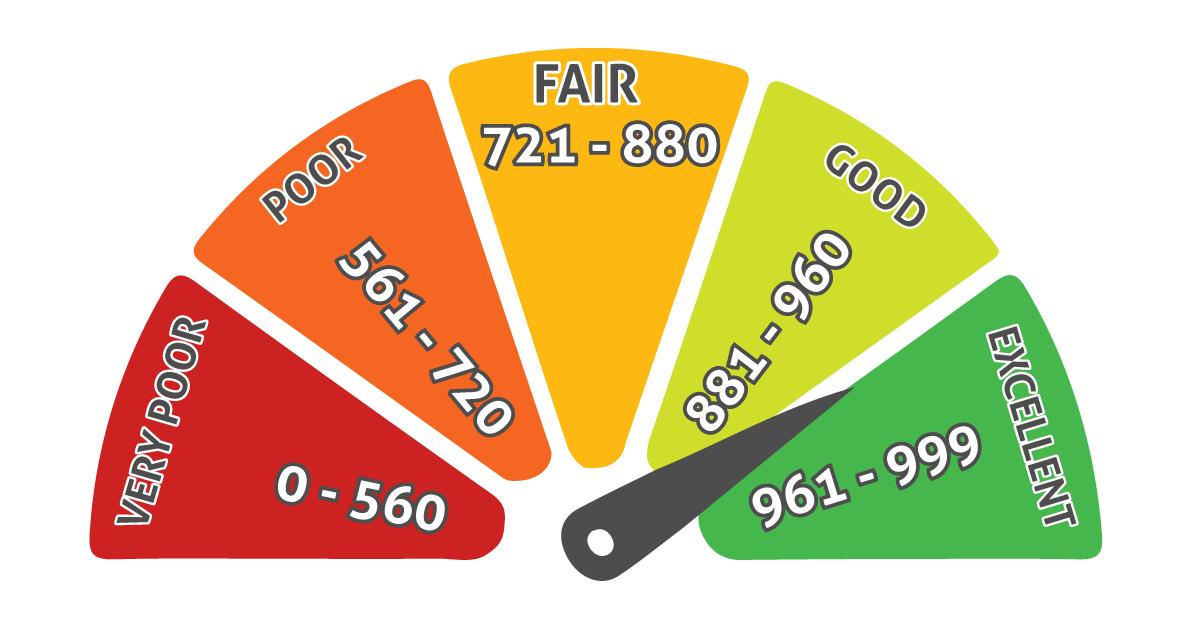

Many businesses have transformed their credit profiles with Savastan0. One small retail shop in Austin saw its credit score jump from fair to excellent within months. By using Savastan0, they established solid trade lines and gained access to better financing options.

A tech startup in San Francisco also shares a success story. They leveraged Savastan0’s resources to secure funding for product development quickly. This allowed them to launch ahead of competitors and attract a loyal customer base.

Even seasoned firms are seeing benefits. A local construction company improved its creditworthiness significantly after adopting the tools offered by Savastan0. It enabled them to negotiate favorable terms with suppliers, enhancing profitability.

These narratives illustrate that Savastan0 isn’t just about numbers; it empowers businesses to seize opportunities and grow confidently in their respective markets.

Tips for Making the Most of Savastan0

To maximize your experience with Savastan0, start by setting clear credit goals. Know what you want to achieve and map out milestones along the way.

Next, ensure that all your business information is accurate and up-to-date on Savastan0. This includes your address, contact details, and financial data. Consistency across platforms boosts credibility.

Engage with other users in the Savastan0 community. Networking can provide insights and strategies that may not be obvious at first glance.

Monitor your credit report regularly through the platform. Understanding where you stand helps you make informed decisions quickly.

Take advantage of any educational resources provided by Savastan0. Knowledge is power when it comes to building strong business credit efficiently.

Alternatives to Savastan0

If Savastan0 cc isn’t the right fit for your business credit needs, there are several alternatives to consider.

One option is CreditStrong. This platform offers a unique blend of credit-building loans designed specifically for businesses. It helps in creating a strong payment history while improving your credit score over time.

Another alternative is Nav. Known for its free credit monitoring services, Nav provides insights into both personal and business credit scores. It’s an excellent resource for those looking to understand their financial standing better.

For those seeking traditional routes, local banks or credit unions might offer small business lines of credit or secured loans tailored to help build your business’s credibility.

Evaluating each choice against your specific goals can lead you toward the best solution for establishing solid business credit without relying solely on Savastan0.

Conclusion

Building strong business credit is essential for any company looking to secure financing and grow. Savastan0 emerges as a powerful tool in this journey, offering unique features designed to streamline the process of establishing business credit quickly and effectively.

With its user-friendly interface and comprehensive resources, Savastan0 equips businesses with the knowledge they need to navigate the often-complex world of credit building. The success stories shared by entrepreneurs who have leveraged this platform highlight its effectiveness in transforming their financial standing.

For those considering alternatives, it’s vital to weigh your options carefully. However, many find that Savastan0 remains unmatched in terms of efficiency and results.

As you embark on your path toward solidifying your business’s financial future, incorporating Savastan0 into your strategy may just be the key you’ve been searching for.

Frequently Asked Questions (FAQ’s)

1. What makes Savastan0 the key to building business credit fast?

Savastan0 offers a proven, step-by-step roadmap that guides businesses through setup, compliance, vendor selection, and credit tiers, eliminating guesswork and accelerating credit growth.

2. Can new businesses with no credit history benefit from Svasatan0.cc?

Yes. Savastan0 is designed for startups and first-time entrepreneurs, providing clear instructions to start building credit immediately.

3. How does Savastan0 help speed up the credit-building process?

By identifying the right vendors, showing the optimal order of credit applications, and ensuring compliance, it reduces delays and increases the chances of faster approvals.

4. What are the first steps recommended by Svasatan0.cc?

Savastan0 guides businesses through proper registration, obtaining an EIN, setting up a business address and phone, creating a professional online presence, and meeting lender requirements.

5. Does Savastan0 show which accounts to apply for first?

Yes. The platform provides curated starter vendors, Net-30 accounts, and credit sources that report to business credit bureaus to help establish a strong foundation quickly.

6. Can I build business credit without relying on my personal credit?

Yes. Svasatan0.cc focuses on establishing business credit in the company’s name and offers options that minimize or eliminate personal guarantees (PG).

7. How quickly can I start seeing results?

Many entrepreneurs see initial approvals within 30–45 days, and with consistent application, can progress to higher-tier credit within 3–6 months.

8. Does Savastan0 help avoid mistakes that slow down credit growth?

Absolutely. It identifies common mistakes such as applying too early, using non-reporting vendors, or inconsistent business information, helping businesses save time and prevent denials.